Step-by-step guide to bootstrapping your new product development – Part 7, Business model design

Part 7: Business model design

Now, we need to work out how we are going to get our share of the value the customer derives from the product.

There are two parts to this.

First, we determine which revenue model (or models) best fit our customer profile, then establish what the pricing should be. This allows us to calculate a key metric for our business: the lifetime value of the customer.

Second, we look at the total cost of finding the customer, selling to them, and getting the product into their hands. This allows us to calculate the second key metric for our business: the cost of customer acquisition.

We'll then pull everything we've got so far together into one summary visualization - the business model canvas.

Let's take a look at this in some more detail.

21) Define the revenue model (0.5 – 10 days)

The revenue model is the way we derive revenue from a product. It is not the price of the product (that comes in the next part).

You may derive multiple revenue streams from the product. Typically, there will only be one revenue stream per customer persona, but multiple revenue streams per customer are certainly not out of the question (for example, you may derive a one-time up-front fee, and then sell them consumables). In a multi-sided market, it is not uncommon to derive revenue in completely different ways from different participants. For example, you may offer a subscription model to one side of the market, and sell aggregate data on a licensing model to the other.

Popular revenue models include:

- One-time up-front charge plus maintenance

- Cost plus

- Hourly rates (e.g. consulting)

- Subscriptions or leasing

- Licensing / royalty

- Consumables

- Upsell high-margin add-on products with a low-margin core product

- Advertising

- Reselling or renting the data collected

- Per-transaction fee

- Usage-based ("the electric company", "Azure")

- "Cell phone plan" - fixed monthly fees + overages in a 12-24 month contract

- Parking meter/penalty charges

- Shared savings

- Shared revenues

- Franchise

- Ops & Maintenance

- Referrals

Remember that different revenue models may allow you to enter different market segments.

For example, the mobile phone market was dominated by fixed-term subscription-based contracts with usage caps, overages and high-margin upsells, but this locked out a large part of the market (specifically, teenagers who couldn't persuade their parents to sign up). They introduced Pay-as-you-go tariffs to capture this market.

To decide which revenue model or models fit best, you need to return to the customer's decision making unit from part 5, and see which offers the best fit for their purchasing process.

22) Define the pricing model (0.5 – 5 days)

Having looked at the revenue model, we can now start to define the pricing model.

The most important rule for pricing is that cost is not the basis for pricing.

Instead, the price should reflect a fair share of the value the product will deliver to the customer.

Again, go back to the Customer Decision Making Unit, and the Value Proposition. Look at the benefit you bring, and the budget they have available, and determine what you think would be a fair price for your product.

It is important to understand that you may have different pricing at different stages of the lifecycle:

- Enthusiasts

- Early adopters

- Early majority (pragmatists)

- Late majority (conservatives)

- Sceptics

It's a good idea to sketch out potential pricing models for all stages right now, but focus on the pricing for your enthusiasts and early adopters to help you gain initial market traction. It is also worth thinking about your Early Majority pricing at this stage, too. I would not waste too much time on late majority and sceptics at this stage.

Validation

It is really important to get some initial validation on both your pricing and revenue models. You can use your standard focus groups, facebook quizzes and landing pages to help test different revenue and pricing propositions, quickly and cheaply, just as you did for the initial value proposition testing. We're going to do some more sophisticated (and possibly expensive) validation in the next part - this is just to help you work out some basic numbers.

23) Calculate the Lifetime Value of a Customer (0.5 days)

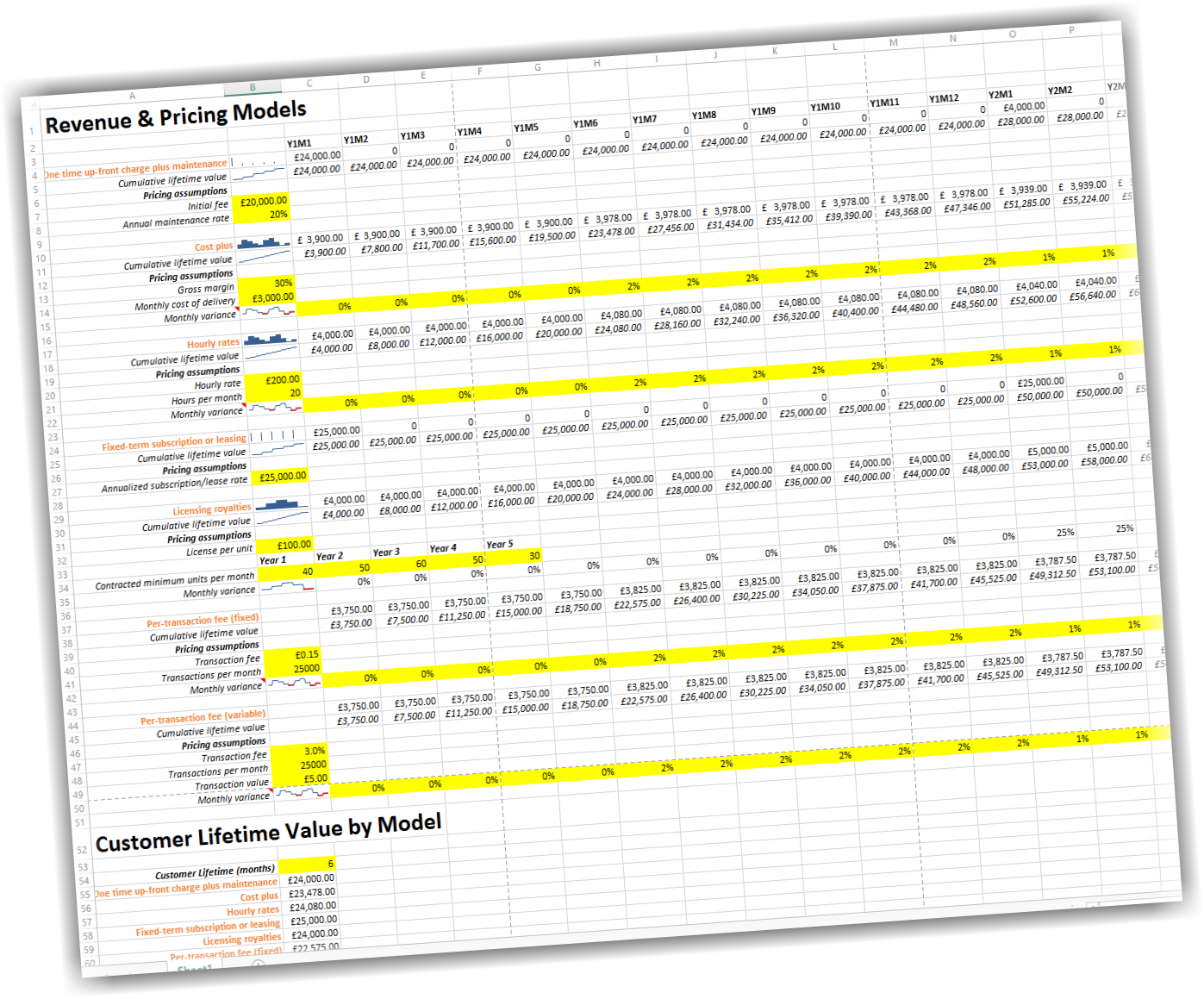

We can now use this data to help us to calculate the lifetime value (LTV) of a customer.

The Lifetime Value (LTV) of a Customer is a prediction of the value that you will derive over the lifetime of this customer's use of the product. We typically cap the lifetime at 5 years (though you may choose longer) - and often the lifetime will be shorter (e.g. for most app vendors).

We use a spreadsheet which looks at our revenue model and pricing, along with the expected customer lifetime with the product, and spits out the customer lifetime value.

You can download an example here.

We use this model while we're experimenting with different revenue and pricing models, to see what impact it has on the LTV.

One particularly interesting use for the spreadsheet is to illustrate the impact of customer retention on different revenue models.

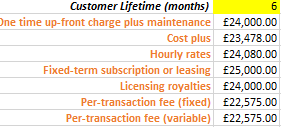

For example, here's what 6 month customer retention looks like

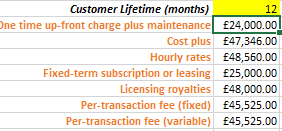

And here's what happens when their lifetime extends to 12 months

And here's what happens when their lifetime extends to 12 months

24) Define the sales process (0.5 – 3 days)

Now, we'll revisit the sales and delivery process from our full life cycle use case.

Taking into account the extra information we got by examining the customer's decision making unit, we can now map out our sales strategy on three horizons: short term, medium term and long term.

For example:

- Short term focuses on demand creation, lead generation and our cheerleading "lighthouse" customers.

- Medium term focuses on closing sales, delivery and deployment, and generating word-of-mouth/references.

- Long term focuses on client management: retention, support, and upselling.

Consider the length of the sales cycle at each stage, and work out what the rate of uptake is going to be - how many new customers are you going to be able to bring on. It's a good idea to model that out quarter-by-quarter. Jot down a note against each quarter that explains exactly what it is you are doing each quarter that influences the uptake (e.g. why will the uptake be 2x up this quarter, but only 25% up next quarter, and flat the quarter after that?)

List the resources you are going to need to get through the sales cycle (roughly how many members of staff in which roles, and how much will they cost). What channels are you going to use to communicate with the customer, and are there any costs attached?

This data enables us to calculate another of our key metrics - the Cost of Customer Acquisition (COCA).

25) Calculate the Cost of Customer Acquisition(0.5 – 1 days)**

The COCA is the total cost of the sales and marketing process which leads to customer acquisition, plus the cost of delivering it to the customer.

The easiest way to do this is by using a top-down process. Rather than looking at a single customer, look at your planned headcount in sales and marketing, and any supporting resources (infrastructure, administration, legal, tech support, deployment and ops) and add up all of those costs.

If you think that any of those people are going to spend time in support, or customer retention (or any other activities) after the initial deployment, deduct that from the total, and divide by the number of customers

This is the COCA.

It's a good idea to look at the COCA on a quarterly basis over the lifetime of the product (or the first 5 years), and plot that on a graph. If all is well, your COCA is decreasing over time!

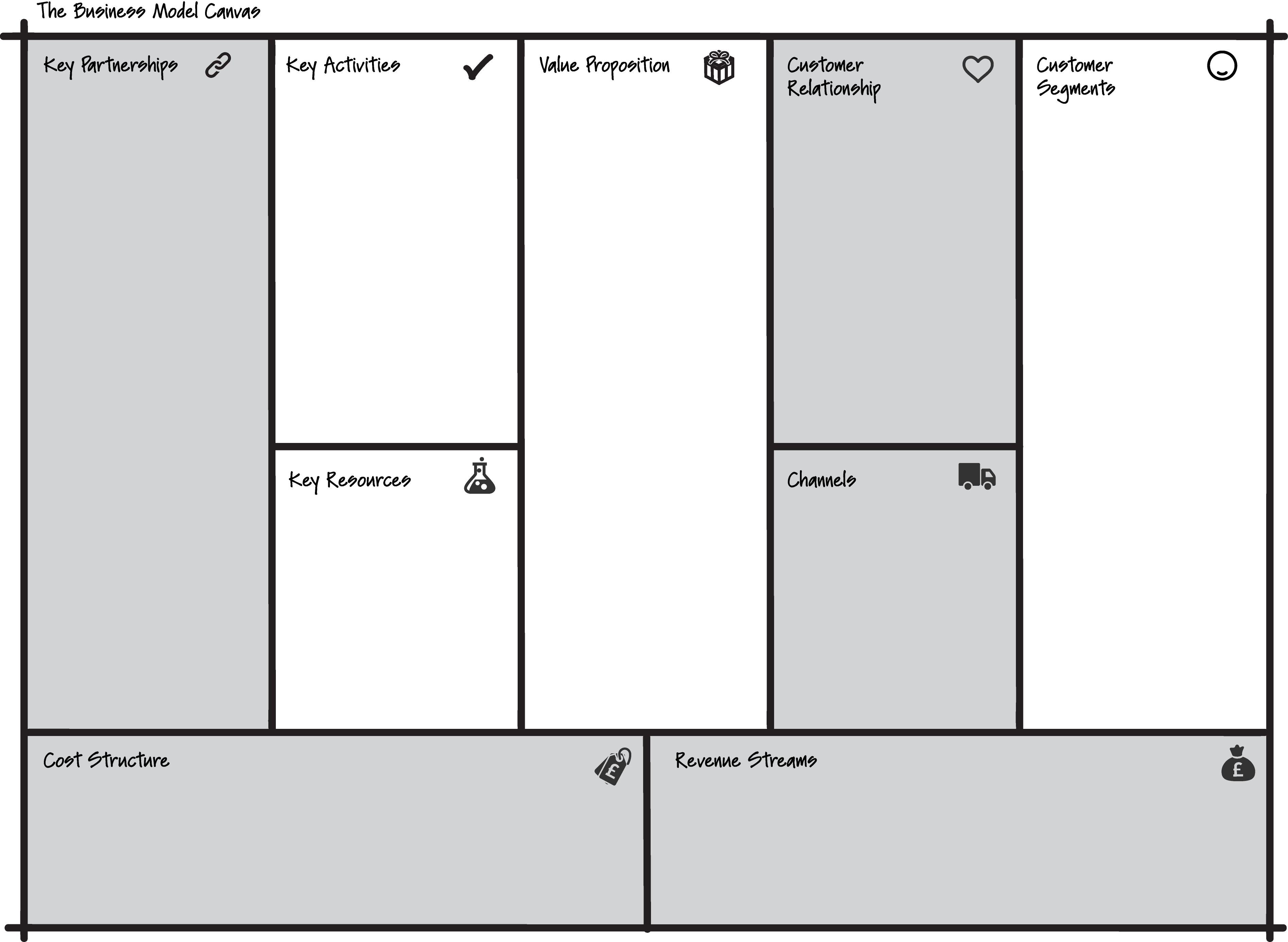

While you're gathering and iterating this data, it is good to gather it together onto a Business Model Canvas. This is a great tool from strategyzer.com for succinctly representing your whole business model.

On it, you can pull together most of the elements we've been working on:

- Key partners - From step 6, suppliers and partners that will participate in delivering the product.

- Key activities - The most important activities for your organisation when delivering the product, from section 24.

- Key resources - The most important resources needed to deliver the product from section 24

- Value proposition - From step 14, the value proposition offered by the product – its core functionality and the potential gains/ pain point relief offered to a customer.

- Customer segment - From step 14, the customer profile, including key tasks, pain points, and desired gains.

- Channels - From step 24, the ways in which the value proposition is communicated to the customer segment

- Customer relationships - From step 24, an outline of the type of relationship established with a customer, and how this relationship will be set up and maintained.

- Cost structure - From step 23 - 25, The COCA, and lifetime costs of maintaining the customer, including software maintenance

- Revenue streams - From steps 21 – 23, the revenue model, pricing model, and Lifetime Value of a Customer.

Next time, we're going to do some final validation of our assumptions, and go on to build our minimum viable product.